DREG is a Boston-based private equity real estate investment and development firm focused across the Americas. We target high-yield ground-up and value-add opportunities, primarily in residential real estate with select commercial and retail components. Our strategy emphasizes disciplined execution, sustainable development, and long-term value creation.

OUR MANAGEMENT TEAM TRACK RECORD

30+ Years In Private Equity Real Estate Investment and Development

± $1 billion in AUM

2+ Continents Investment Experience

PEOPLE

As a boutique firm with institutional discipline, we combine emerging talent and seasoned leadership to execute across the full real estate investment lifecycle—from sourcing and acquisition to development, asset management, and exit. We leverage data-driven systems, a flexible operating structure, and a performance-driven culture aligned with investor outcomes to maximize efficiency and deliver superior results. Our integrated approach positions us to consistently create value across markets and cycles.

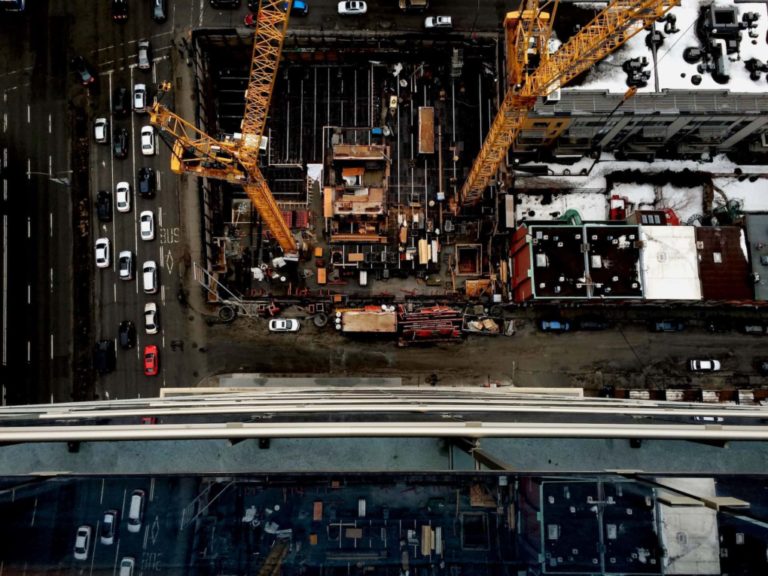

PORTFOLIO

Our approach centers on identifying value-creation opportunities and executing on complex projects that others often overlook. We apply a disciplined, analytical understanding of risk—focusing on its identification, assessment, and mitigation—to unlock potential in underutilized assets. Every investment is guided by a commitment to sustainability, innovation, and technology, with the goal of building more productive, resilient communities and long-term value for stakeholders

PARTNERSHIP

No two investments are alike. At DREG, we tailor each project to reflect its unique market context, investment goals, and community dynamics. We collaborate closely with local stakeholders to ensure our developments are both contextually relevant and economically resilient. Our work is guided by a belief that long-term value is created through responsible development, strong local partnerships, and a commitment to delivering lasting, positive impact alongside compelling returns.

CORE COMPETENCIES

BROAD ASSET CLASS EXPERTISE

Residential | Mixed-Use | Master-Planned or Single-Parcel Land

IN-HOUSE DEVELOPMENT & OPERATING CAPABILITIES

Vertically Integrated Model In-house expertise to develop, operate and manage mid to large-scale asset class

DIVERSE CORE DISCIPLINES

Cross-border, international transactional experience | Global relationships and vantage points | Full-spectrum private equity disciplines, including real estate, special opportunities and distress investing, joint-ventures & acquisitions